When people compare bank products, one of the most common questions is APY vs APR. These two terms—Annual Percentage Yield (APY) and Annual Percentage Rate (APR)—look similar but mean very different things. APY is used to describe how much you earn on deposits, while APR explains how much you pay on loans. Understanding APY vs APR is essential for both academic study in finance and mathematics, and for practical financial decision-making in everyday life.

This comprehensive article will explain APY vs APR from both academic and financial perspectives. We’ll cover definitions, formulae, examples, comparisons, practical applications, and real-world insights.

Introduction to Interest Rates

Interest rates are the backbone of modern finance. They determine the cost of borrowing and the reward for saving. Banks, credit unions, and financial institutions use different ways to express interest, and that’s where APY and APR come in.

- APR (Annual Percentage Rate): The yearly cost of borrowing money, expressed as a percentage of the loan amount.

- APY (Annual Percentage Yield): The yearly return on savings or investments, taking compounding into account.

APY vs APR: Definitions

What is APR?

APR is the annualized cost of borrowing money. It includes the interest rate plus certain fees, giving borrowers a clearer picture of the true cost of a loan.

Formula for APR (simplified):

What is APY?

APY is the annualized return on savings or investments, factoring in compounding. It shows how much you actually earn in a year.

Formula for APY:

Where:

- = nominal interest rate

- = number of compounding periods per year

APY vs APR: Key Differences

| Feature | APR | APY |

|---|---|---|

| Purpose | Cost of borrowing | Return on savings/investments |

| Includes Fees | Yes | No |

| Considers Compounding | No | Yes |

| Higher or Lower | Usually lower than APY for same rate | Higher due to compounding |

| Common Uses | Loans, credit cards, mortgages | Savings accounts, CDs, investments |

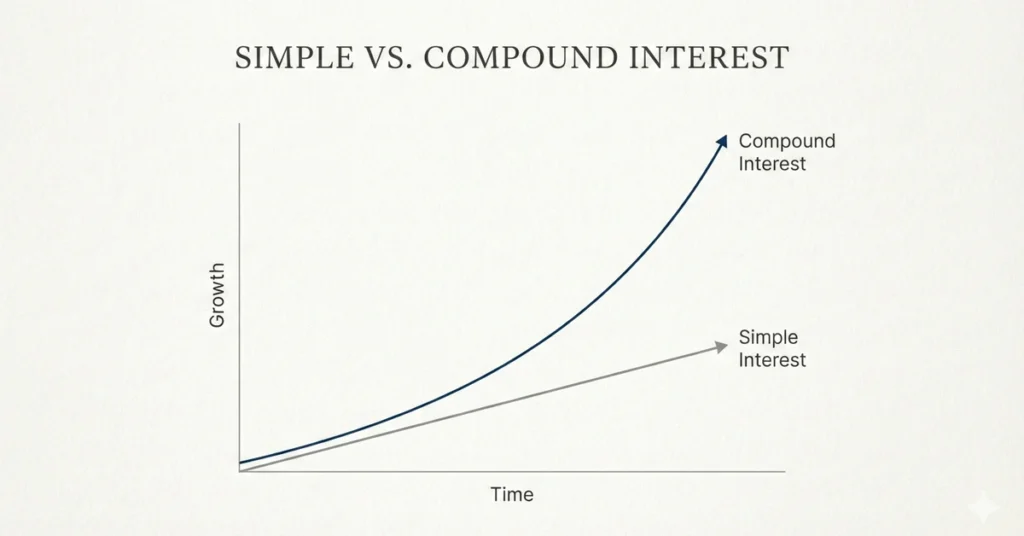

APR is based on linear calculations, while APY reflects exponential growth due to compounding. See a detailed comparison of Simple Interest vs Compound Interest to understand the math behind APY vs APR for a deeper academic perspective.

Academic Perspective: Why Students Study APY vs APR

In finance and economics courses, APY vs APR is taught to illustrate:

- The difference between linear and exponential calculations.

- How compounding changes outcomes.

- Real-world applications of percentages.

Students often solve problems like:

- “Find the APR on a $10,000 loan with $500 in fees and 5% interest.”

- “Find the APY on a savings account with 5% interest compounded monthly.”

Read Appendix A to Part 1030 — Annual Percentage Yield Calculation by CFPB

Financial Perspective: Why APY vs APR Matters

For consumers, APY vs APR can mean the difference between saving money and losing money.

- Borrowers: Need to understand APR to know the true cost of loans.

- Savers: Need to understand APY to know the true return on deposits.

- Investors: Compare APY to evaluate different investment products.

Real-World Examples

Example 1: Loan with APR

You borrow $10,000 at 6% interest with $200 in fees.

So the true cost of borrowing is 8%.

APR represents the true cost of borrowing, including fees. In many ways, it’s similar to how insurers calculate premiums. See how insurance premiums are calculated to compare with APR costs in borrowing for a practical analogy.

Example 2: Savings Account with APY

You deposit $10,000 at 6% interest compounded monthly.

So you earn slightly more than the nominal rate due to compounding.

Savings accounts often advertise APY to show how much you earn annually. But beyond interest, you also need to know your deposits are safe. Explore How Banks Store Money Safely and why your deposits stay secure)

The Power of Compounding in APY

APY shows the effect of compounding. Even small differences in compounding frequency can add up.

Example:

- 5% annual interest compounded annually = 5% APY.

- 5% annual interest compounded monthly = 5.12% APY.

- 5% annual interest compounded daily = 5.13% APY.

APY shows the effect of compounding. Even small differences in compounding frequency can add up. Learn more about What is Compound Interest and how compounding works in savings accounts to see why APY reflects exponential growth.

APR in Practice

APR is critical for loans and credit cards.

- Credit Cards: APR can range from 15% to 25%.

- Mortgages: APR includes interest plus closing costs.

- Car Loans: APR shows the true cost beyond the advertised rate.

While APY shows your nominal return, inflation reduces your real earnings. Understand how inflation affects your APY earnings and long-term savings to make smarter financial decisions.

APY vs APR in Everyday Life

- Savings Accounts: Banks advertise APY to show how much you earn.

- Loans: Banks advertise APR to show how much you pay.

- Credit Cards: APR determines how quickly debt grows.

Extended Academic Explanation

Why APR is Linear

APR is based on the nominal interest rate plus fees. It does not account for compounding, so it grows linearly.

Why APY is Exponential

APY accounts for compounding, so it grows exponentially.

Extended Financial Explanation

Mortgages

Mortgages use APR to show the true cost of borrowing.

Certificates of Deposit (CDs)

CDs use APY to show the true return on savings.

Investments

Mutual funds and stocks may advertise APY to show compounded returns.

Case Study: Credit Card Debt vs Savings Account

- Credit Card: $5,000 balance at 20% APR.

- Savings Account: $5,000 deposit at 2% APY.

After one year:

- Credit card debt grows to $6,000.

- Savings grows to $5,100.

This shows why understanding APY vs APR is critical.

Behavioral Finance Insight

Consumers often confuse APY vs APR. Banks may advertise low APRs or high APYs to attract customers. Financial literacy helps people make better decisions.

Advanced Applications

- Corporate Finance: Companies use APR to evaluate borrowing costs.

- Personal Finance: Individuals use APY to evaluate savings.

- Government Bonds: APY shows yield to maturity.

Practical Tips

- For Borrowers: Always compare APR, not just interest rate.

- For Savers: Look at APY to know true returns.

- Check Compounding Frequency: More frequent compounding increases APY.

- Understand Fees: APR includes fees; APY does not.

Conclusion

Understanding APY vs APR is vital for both academic learning and financial decision-making. APR shows the true cost of borrowing, while APY shows the true return on savings. By mastering these concepts, students gain mathematical insight, and individuals gain financial literacy.

Key Takeaways

- APR = cost of borrowing.

- APY = return on savings.

- APR is linear; APY is exponential.

- Borrowers should focus on APR; savers should focus on APY.

Does APY always make savings grow faster than APR?

No. APY applies to savings and investments, while APR applies to loans. They measure different things, so one is not “better” than the other—it depends on whether you are saving or borrowing.

How does compounding frequency affect APY vs APR?

APY increases with more frequent compounding (monthly, daily), while APR does not change with compounding because it is a linear measure of borrowing cost.

How do APY vs APR affect mortgages?

APR shows the total cost of a mortgage, including fees and interest. APY is not used for mortgages but is relevant for savings accounts you might use to build a down payment.

How can I use APY vs APR to make better financial choices?

Compare APRs when borrowing to minimize costs, and compare APYs when saving to maximize returns. Always consider compounding frequency and fees.

Explore MORE ARTICLES