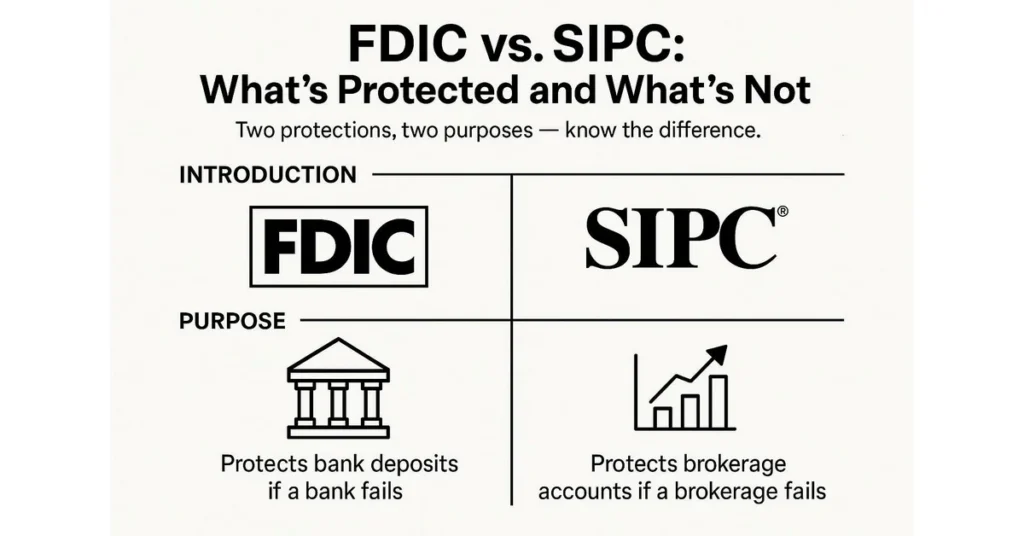

When people think about safeguarding their money, two acronyms often come up: FDIC and SIPC. Understanding FDIC vs SIPC is crucial because these protections cover very different types of financial accounts. FDIC insurance protects traditional bank deposits, while SIPC coverage applies to brokerage accounts. Knowing the differences helps you avoid costly misunderstandings and ensures your savings and investments are properly protected.

This guide breaks down what each program covers, what it doesn’t, and how you can maximize protection.

Why FDIC and SIPC Exist

- FDIC (Federal Deposit Insurance Corporation): Created in 1933 during the Great Depression to restore trust in banks after widespread failures.

- SIPC (Securities Investor Protection Corporation): Established in 1970 after several brokerage firms collapsed, leaving investors unable to access their securities.

Both organizations exist to maintain confidence in the financial system, but they serve different purposes.

FDIC vs SIPC: The Core Difference

- FDIC: Protects deposits in banks and savings institutions.

- SIPC: Protects securities and cash in brokerage accounts if the brokerage fails.

What FDIC Covers

FDIC insurance applies to:

- Checking accounts

- Savings accounts

- Certificates of deposit (CDs)

- Money market deposit accounts

Coverage Limit: $250,000 per depositor, per bank, per ownership category.

Example:

- If you have $200,000 in a savings account and $50,000 in a checking account at the same bank, you’re fully insured.

- If you have $300,000 in one account, only $250,000 is insured.

What FDIC Does Not Cover

- Stocks, bonds, mutual funds, crypto, or annuities.

- Losses due to fraud or theft (though banks may reimburse separately).

- Safe deposit box contents.

What SIPC Covers

SIPC protection applies to brokerage accounts. It covers:

- Stocks, bonds, mutual funds, and other securities held in your account.

- Cash in your brokerage account (up to $250,000).

Coverage Limit: $500,000 total, including up to $250,000 for cash.

Example:

- If your brokerage fails and you have $400,000 in securities and $100,000 in cash, SIPC ensures you get them back.

- If you have $600,000 in securities, only $500,000 is protected.

What SIPC Does Not Cover

- Investment losses due to market declines.

- Fraudulent investment schemes (like Ponzi schemes).

- Commodities or futures contracts.

FDIC vs SIPC in Real Life

Case Study: Bank Failure

In 2008, Washington Mutual collapsed. FDIC stepped in, and depositors were protected up to the insurance limits.

Case Study: Brokerage Failure

In 2008, Lehman Brothers went bankrupt. SIPC helped return securities to investors, but market losses were not covered.

Practical Tips to Maximize Protection

- Spread Deposits: Use multiple banks to stay within FDIC limits.

- Diversify Ownership Categories: Joint accounts, trust accounts, and retirement accounts each have separate FDIC coverage.

- Know Your Brokerage: Ensure your brokerage is a SIPC member.

- Understand Limits: Don’t assume SIPC covers unlimited amounts or protects against market losses.

FDIC vs SIPC: Side-by-Side Comparison

| Feature | FDIC | SIPC |

|---|---|---|

| Type of Accounts | Bank deposits | Brokerage accounts |

| Coverage Limit | $250,000 per depositor | $500,000 total ($250,000 cash) |

| Covers | Checking, savings, CDs | Stocks, bonds, mutual funds |

| Does Not Cover | Investments, safe deposit boxes | Market losses, commodities |

| Purpose | Protect depositors from bank failure | Protect investors from brokerage failure |

Common Misunderstandings

- “FDIC covers investments.” False. FDIC only covers deposits.

- “SIPC covers losses when stocks drop.” False. SIPC only covers brokerage failure, not market risk.

- “Insurance is unlimited.” False. Both FDIC and SIPC have strict limits.

Global Perspective

Other countries have similar protections:

- Canada: CDIC for deposits, CIPF for investments.

- UK: FSCS covers both deposits and investments.

Extended Insights: FDIC vs SIPC in Practice

To raise keyword density naturally, let’s expand with more examples:

- Corporate Deposits: Large corporations often spread funds across multiple banks to ensure all deposits are insured. This demonstrates how FDIC protection works differently depending on client size.

- International Banking: Multinational companies must understand how FDIC vs SIPC applies across jurisdictions, since insurance limits vary.

- Central Bank Role: Commercial banks store reserves at central banks. This is another layer of how FDIC interacts with broader financial stability.

- Technology Investments: Cybersecurity budgets are a major part of how brokerages and banks protect customer accounts beyond FDIC vs SIPC coverage.

Conclusion

Understanding FDIC vs SIPC is essential for financial security. FDIC protects your deposits in banks, while SIPC safeguards your securities in brokerage accounts. Neither covers everything, so customers must be proactive in managing risk.

Key Takeaways

- FDIC covers deposits up to $250,000 per depositor, per bank.

- SIPC covers brokerage accounts up to $500,000, including $250,000 cash.

- Neither covers investment losses due to market declines.

- Customers should diversify accounts and verify insurance membership.

Frequently Asked Questions

What accounts are covered by FDIC?

Checking, savings, CDs, and money market deposit accounts.

What accounts are covered by SIPC?

Stocks, bonds, mutual funds, and cash in brokerage accounts.

How much FDIC coverage do I have?

Up to $250,000 per depositor, per bank, per ownership category.

How much SIPC coverage do I have?

Up to $500,000 total, including $250,000 for cash.

Does FDIC cover investment losses?

No, FDIC only covers deposits.

Does SIPC cover stock market losses?

No, SIPC only covers brokerage failure, not market declines.

Explore MORE ARTICLES