Insurance premiums often feel like a mystery. You pay a certain amount each month or year, but how exactly did the company decide on that figure? The truth is, premiums are not random—they’re carefully calculated based on a mix of risk, age, coverage, and other personal factors.

Understanding how premiums are determined can help you make smarter financial decisions, choose the right coverage, and even lower your costs. Let’s break it down step by step in a clear, human way.

What Is an Insurance Premium?

An insurance premium is the price you pay to keep your policy active. Think of it as your membership fee for financial protection. Whether it’s health insurance, car insurance, or life insurance, the premium ensures that the insurer will cover you if something goes wrong.

Premiums can be:

- Monthly (common for health and auto insurance)

- Quarterly or annually (common for life insurance or property insurance)

The amount isn’t fixed for everyone—it’s tailored to your personal situation.

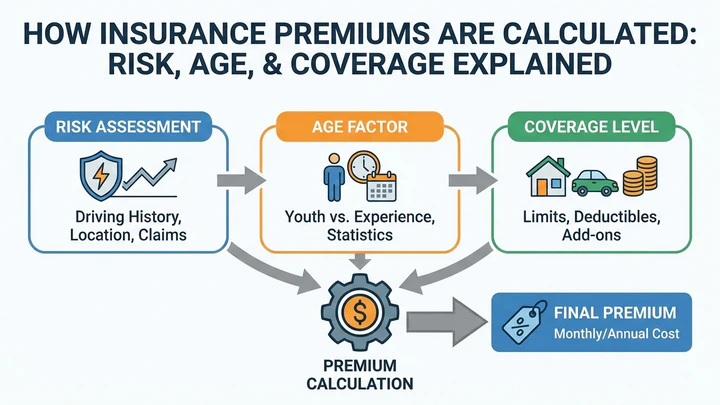

The Core Factors Behind Premium Calculation

Insurance companies rely on data, statistics, and risk models to set premiums. Here are the main drivers:

1. Risk Profile

Risk is the heart of insurance. The higher the chance of you filing a claim, the higher your premium.

- Car Insurance Example: A driver with multiple speeding tickets is considered riskier than someone with a clean record.

- Health Insurance Example: A person with chronic health conditions may pay more than someone in excellent health.

Insurers use historical data to predict the likelihood of claims.

2. Age

Age plays a huge role in insurance pricing.

- Life Insurance: Younger people pay lower premiums because they’re statistically less likely to die soon.

- Health Insurance: Premiums rise with age since medical needs increase over time.

- Auto Insurance: Teen drivers often face higher premiums due to inexperience, while middle-aged drivers usually enjoy lower rates.

3. Coverage Amount and Type

The more protection you want, the more you’ll pay.

- Basic Coverage: Covers essentials, costs less.

- Comprehensive Coverage: Includes extras like theft, natural disasters, or extended medical benefits, which increase premiums.

Think of it like buying a car: a basic model is cheaper, but adding features raises the price.

4. Location

Where you live matters.

- Car Insurance: Urban areas with heavy traffic and higher accident rates lead to higher premiums.

- Home Insurance: Living in a flood-prone or earthquake-prone region increases costs.

- Health Insurance: Premiums vary by state or country due to healthcare costs and regulations.

5. Lifestyle and Habits

Insurers look at your daily choices.

- Smoking, drinking, or risky hobbies (like skydiving) can raise life and health insurance premiums.

- Driving long distances daily may increase auto insurance costs.

How Insurers Actually Calculate Premiums

Behind the scenes, insurers use actuarial science—a mix of math, statistics, and economics.

Step 1: Assess Risk

They analyze your personal data (age, health, driving record, etc.) and compare it to large datasets of similar people.

Step 2: Estimate Claim Probability

They calculate the likelihood of you filing a claim and how much it might cost.

Step 3: Add Operating Costs

Insurance companies also factor in administrative expenses, marketing, and profit margins.

Step 4: Adjust for Discounts or Penalties

Safe drivers, non-smokers, or people who bundle multiple policies often get discounts. Risky behavior adds penalties.

Examples Across Different Insurance Types

Car Insurance

- Young driver (18 years old): Higher premium due to inexperience.

- Middle-aged driver (40 years old): Lower premium if they have a clean record.

- Driver with accidents: Premium spikes because of proven risk.

Health Insurance

- Healthy 25-year-old: Lower premium, fewer expected medical costs.

- 55-year-old with diabetes: Higher premium due to increased healthcare needs.

Life Insurance

- 30-year-old non-smoker: Affordable premium, long life expectancy.

- 50-year-old smoker: Much higher premium due to health risks.

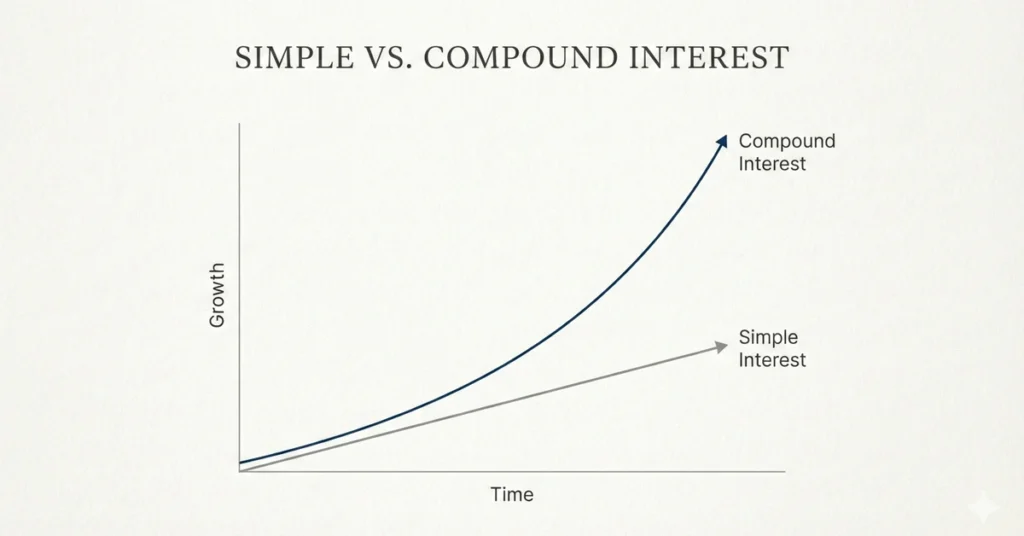

Why Premiums Change Over Time

Premiums aren’t static. They can rise or fall based on:

- Age progression (you get older, risk increases)

- Claim history (filing multiple claims raises costs)

- Market conditions (inflation, healthcare costs, or natural disasters affect pricing)

- Policy adjustments (adding coverage or riders increases premiums)

Unique Angles: The Human Side of Premiums

1. Psychology of Risk

Insurers don’t just look at numbers—they consider human behavior. For example, people who buy comprehensive coverage often take fewer risks, which can lower claims overall.

2. Technology’s Role

Modern insurers use telematics (devices in cars that track driving habits) or fitness apps (tracking health activity) to personalize premiums. Safe driving or healthy living can literally lower your costs.

3. The Fairness Debate

Some argue premiums penalize people for factors beyond their control, like genetics or location. Others see them as fair because they reflect actual risk.

How to Lower Your Insurance Premiums

You can’t control everything, but you can take steps to reduce costs:

- Bundle Policies: Combine home, auto, and life insurance with one company.

- Improve Lifestyle: Quit smoking, exercise regularly, and avoid risky hobbies.

- Maintain a Clean Record: Drive safely and avoid traffic violations.

- Choose Higher Deductibles: Agree to pay more out-of-pocket in exchange for lower premiums.

- Shop Around: Compare insurers—prices vary widely.

Quick Comparison: Risk vs Age vs Coverage

| Factor | Effect on Premium | Example |

|---|---|---|

| Risk | Higher risk = higher premium | Smoker pays more for life insurance |

| Age | Younger = cheaper, older = costlier | 25-year-old driver vs 70-year-old driver |

| Coverage | More coverage = higher premium | Basic health plan vs comprehensive plan |

Key Takeaways

- Insurance premiums are calculated using risk, age, coverage, location, and lifestyle factors.

- Younger, healthier, and safer individuals generally pay less.

- Premiums rise with age, risky behavior, or higher coverage needs.

- Insurers use actuarial science to balance fairness, risk, and profitability.

- You can lower premiums by improving habits, bundling policies, or shopping around.

Final Thoughts

Insurance premiums may seem complicated, but they boil down to one idea: risk management. The insurer is betting on how likely you are to need financial protection, and your premium reflects that bet.

By understanding the factors—risk, age, and coverage—you gain control. Instead of feeling powerless when you see your premium bill, you’ll know exactly why it’s priced that way and how to influence it.

Explore MORE ARTICLES