When students and investors ask about present value vs future value, they are really asking about two of the most fundamental concepts in finance. Present value tells us what money in the future is worth today, while future value tells us what money today will be worth in the future. These formulas are essential for academic study in economics and mathematics, and equally critical for financial planning, investing, and decision-making.

This comprehensive article will explain present value vs future value in detail, using definitions, formulas, examples, comparisons, and practical applications. We’ll break down the math simply, while also showing how it applies in real-world finance.

Introduction to Time Value of Money

The foundation of present value vs future value is the concept of the time value of money. This principle states that money today is worth more than the same amount in the future because it can be invested to earn interest.

- Future Value (FV): How much money today will grow to in the future.

- Present Value (PV): How much future money is worth today, discounted back using interest rates.

Present Value vs Future Value: Definitions

Present Value (PV)

Present value is the current worth of a sum of money that will be received or paid in the future, discounted at a specific interest rate.

Formula:

Where:

- = Present Value

- = Future Value

- = Interest rate (per period)

- = Number of periods

Future Value (FV)

Future value is the amount of money an investment will grow to over time, given a certain interest rate.

Formula:

Where:

- = Future Value

- = Present Value

- = Interest rate (per period)

- = Number of periods

Present Value vs Future Value: Key Differences

| Feature | Present Value | Future Value |

|---|---|---|

| Meaning | Value today of future money | Value in future of today’s money |

| Formula | ||

| Focus | Discounting | Compounding |

| Use Cases | Valuing bonds, loans, investments | Projecting savings, investments |

| Growth | Decreases with time | Increases with time |

Academic Perspective: Why Students Study Present Value vs Future Value

In finance and economics courses, present value vs future value is taught to illustrate:

- The difference between discounting and compounding.

- How interest rates affect value over time.

- Real-world applications in investments, loans, and retirement planning.

Students often solve problems like:

- “Find the present value of $10,000 received in 5 years at 8% interest.”

- “Find the future value of $10,000 invested today at 8% interest for 5 years.”

Watch Video Explanation

Financial Perspective: Why Present Value vs Future Value Matters

For consumers and investors, present value vs future value can mean the difference between making or losing money.

- Borrowers: Need to understand present value to know the cost of loans.

- Investors: Use future value to project growth of savings.

- Businesses: Apply both to evaluate projects and investments.

Real-World Examples

Example 1: Present Value of Future Cash

You expect to receive $10,000 in 5 years. The discount rate is 8%.

So $10,000 in 5 years is worth $6,805 today.

Example 2: Future Value of Investment

You invest $10,000 today at 8% interest for 5 years.

So $10,000 today grows to $14,690 in 5 years.

Learn about Inflation

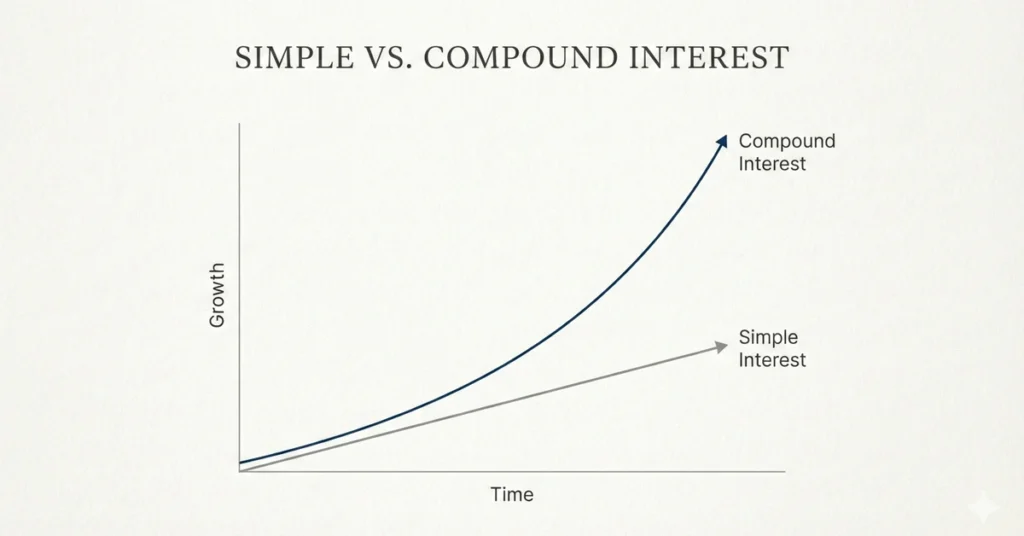

The Power of Compounding and Discounting

- Compounding: Future value grows exponentially because interest is earned on interest.

- Discounting: Present value shrinks because future money is worth less today.

Graphical Comparison

- Present Value: Downward curve, showing how future money loses value when discounted.

- Future Value: Upward curve, showing how today’s money grows with compounding.

Practical Applications

- Loans: Present value helps calculate how much future payments are worth today.

- Savings Accounts: Future value shows how deposits grow over time.

- Retirement Planning: Both PV and FV are used to plan contributions and withdrawals.

- Business Investments: Companies use PV to evaluate projects (Net Present Value).

Insights: Interest Rates and Time

- Higher interest rates increase future value but decrease present value.

- Longer time periods magnify both compounding and discounting effects.

Extended Academic Explanation

Why Future Value is Exponential

Each period, interest is added to the principal, increasing the base for the next calculation.

Why Present Value is Discounted

Future money is divided by the growth factor, reducing its value today.

Extended Financial Explanation

Bonds

Bond pricing uses present value to discount future coupon payments.

Retirement Savings

Future value projects how contributions grow over decades.

Business Valuation

Net Present Value (NPV) uses present value to evaluate investments.

Case Study: Retirement Planning

Suppose you want $1,000,000 at retirement in 30 years. Interest rate is 7%.

So you need to invest $131,000 today to reach $1,000,000 in 30 years.

Behavioral Finance Insight

Psychologically, people often underestimate compounding and discounting. Teaching present value vs future value helps correct this bias, enabling better savings and investment decisions.

Advanced Applications

- Net Present Value (NPV): Evaluates projects by discounting future cash flows.

- Internal Rate of Return (IRR): Uses present value vs future value to measure profitability.

- Annuities: Both PV and FV formulas are used to value regular payments.

Practical Tips

- For Borrowers: Use present value to understand loan costs.

- For Savers: Use future value to project growth.

- Check Interest Rates: Higher rates magnify effects.

- Plan Early: Longer time horizons increase compounding benefits.

Conclusion

Understanding present value vs future value is vital for both academic learning and financial decision-making. Present value discounts future money to today’s terms, while future value compounds today’s money into tomorrow’s terms. By mastering these concepts, students gain mathematical insight, and individuals gain financial literacy.

Key Takeaways

- Present value discounts future money to today.

- Future value compounds today’s money into the future.

- Interest rates and time affect both.

- Borrowers focus on present value; savers focus on future value.

Frequently Asked Questions

Are present value vs future value formulas reliable in volatile markets?

They provide a baseline, but assumptions of constant rates limit accuracy in highly volatile or uncertain conditions.

Can present value vs future value be applied with continuous compounding?

Yes, formulas adapt to and , often used in advanced finance.

How does risk adjustment affect present value vs future value?

Higher risk raises discount rates, lowering present value, while future value projections may be adjusted with scenario probabilities.

How do inflation and discount rates interact with present value vs future value?

Inflation reduces real present value and can distort future value unless adjusted for purchasing power.

Explore MORE ARTICLES