What Is an Insurance Premium?

An insurance premium is the amount of money you pay to an insurance company in exchange for coverage. Think of it as the “price tag” of your insurance policy. It can be paid monthly, quarterly, or annually, depending on the agreement. The insurer collects this premium to provide financial protection against risks such as accidents, illness, or property damage.

Difference Between Premium, Sum Assured, and Deductible

It’s easy to confuse these terms, but they represent different aspects of an insurance policy:

- Premium: The cost of the policy, i.e., what you pay regularly to keep your insurance active.

- Sum Assured: The maximum amount the insurer will pay out in case of a claim. For example, if your life insurance has a sum assured of $100,000, that’s the benefit your family receives.

- Deductible: The portion of expenses you must pay out of pocket before the insurance coverage kicks in. For example, if your health insurance has a $500 deductible, you pay the first $500 of medical bills before the insurer contributes.

Monthly vs Annual Premium

Insurance premiums can be structured in different payment cycles:

- Monthly Premiums:

- Smaller, regular payments.

- Easier for budgeting, especially for individuals with steady monthly income.

- May include slight administrative fees, making them marginally more expensive over time.

- Annual Premiums:

- One lump-sum payment for the entire year.

- Often cheaper overall because insurers may offer discounts for upfront payment.

- Requires more financial planning since the payment is larger at once.

Example: If your annual premium is $1,200, you could pay:

- $100 per month (12 installments), or

- $1,200 once annually (sometimes discounted to $1,150).

An insurance premium is the ongoing cost of protection. Understanding how it differs from the sum assured and deductible, and choosing between monthly or annual payments, helps you manage your finances and select the right insurance plan.

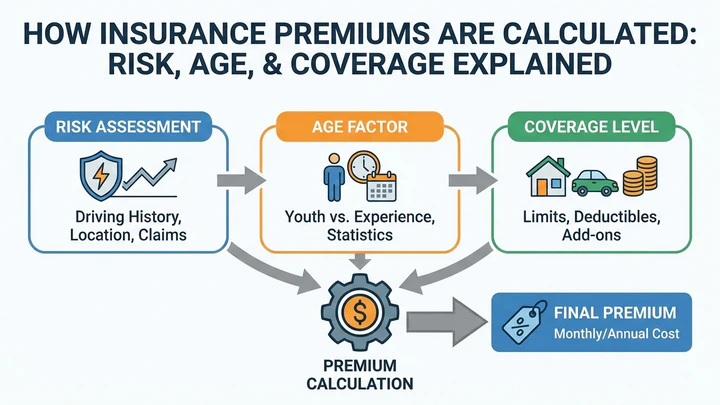

How Insurers Decide Your Premium

Insurance companies rely on data, statistics, and risk models to set premiums. Here are the main drivers:

Insurance premiums aren’t random numbers—they’re carefully calculated using a mix of mathematics, risk analysis, and business logic. Understanding the basics of how insurers set premiums helps explain why two people buying the same policy might pay very different amounts.

Basic Pricing Logic

At its core, the premium is designed to cover expected costs and ensure the insurer remains profitable. A simplified formula looks like this:

- Expected Risk: Probability of a claim being made (e.g., likelihood of illness, accident, or damage).

- Coverage Cost: The financial payout if a claim occurs (sum assured or claim amount).

- Administrative Expenses: Costs of running the insurance company (staff, technology, marketing).

- Profit Margin: Added to ensure the insurer remains sustainable and competitive.

Simplified Explanation of Actuarial Pricing

Insurance companies employ actuaries—specialists who use statistics, probability, and financial models to estimate risk.

- They analyze large datasets (e.g., accident rates, medical histories, mortality tables).

- They predict the likelihood of claims for different groups of people.

- They adjust premiums based on age, health, occupation, lifestyle, and coverage type.

In simple terms: actuaries calculate “how risky you are” and “how much coverage costs,” then insurers add expenses and profit margins to arrive at your premium.

Why Premiums Differ for Two People Buying the Same Policy

Even if two people buy the same insurance product, their premiums may vary because of differences in risk factors:

- Age: Younger individuals usually pay lower premiums for health or life insurance because they are statistically less likely to claim.

- Health Condition: A person with chronic illness may pay more than someone in good health.

- Occupation: Riskier jobs (construction, mining) attract higher premiums compared to office work.

- Lifestyle: Smoking, drinking, or high-risk hobbies (like skydiving) increase premiums.

- Coverage Amount: Higher sum assured or broader coverage naturally raises the premium.

Example:

- Person A: 25 years old, non-smoker, office worker → Lower premium.

- Person B: 45 years old, smoker, construction worker → Higher premium.

Both may buy the same health insurance plan, but Person B’s premium will be significantly higher due to elevated risk.

Premiums are not arbitrary—they’re carefully calculated using risk probabilities, coverage costs, and business expenses. Actuarial science ensures fairness and sustainability, while individual risk factors explain why premiums differ across people.

Key Factors That Affect Insurance Premiums

Insurance premiums are not fixed; they vary depending on several personal and policy-related factors. Understanding these helps explain why two people may pay very different amounts for seemingly similar coverage.

Age

- Younger individuals usually pay lower premiums for life and health insurance because they are statistically less likely to claim.

- Older applicants face higher premiums due to increased health risks and shorter life expectancy.

Risk Profile

- Insurers assess how risky you are to cover.

- Occupation, hobbies, and lifestyle choices (e.g., smoking, extreme sports) all influence your risk profile.

- Higher risk = higher premium.

Coverage Amount

- The larger the sum assured or coverage limit, the higher the premium.

- Example: A $500,000 life insurance policy will cost more than a $100,000 policy because the insurer’s potential payout is greater.

Policy Term

- Longer policy terms may lock in lower premiums but require consistent payments over time.

- Shorter terms may have higher premiums per year but less long-term commitment.

Health and Lifestyle

- Health conditions, medical history, and habits like smoking or drinking directly affect premiums.

- A healthy, non-smoking applicant pays less compared to someone with chronic illness or high-risk lifestyle choices.

Location

- Where you live matters.

- For motor insurance, accident rates in your city influence premiums.

- For health insurance, local healthcare costs and availability of hospitals affect pricing.

Claims History (Motor/Health Insurance)

- Frequent claims in the past increase premiums because insurers see you as a higher risk.

- A clean claims history often qualifies for discounts or “no-claim bonuses.”

Premiums are shaped by a mix of personal factors (age, health, lifestyle) and policy choices (coverage, term, claims history). Knowing these helps you make smarter decisions when selecting insurance and managing costs.

Role of Risk Assessment

Insurance premiums are not just guessed—they’re the result of a structured process called underwriting, where insurers evaluate how risky it is to provide coverage to a particular person or group. Let’s break this down in simple terms.

What Underwriting Means

- Underwriting is the process insurers use to decide whether to offer coverage, at what price, and under what conditions.

- It involves analyzing personal details (like age, health, occupation) and policy details (like coverage amount and term).

- The goal is to balance fairness for customers with financial sustainability for the insurer.

How Insurers Assess Probability of Claim

- Insurers rely on statistics and historical data to estimate the likelihood of a claim.

- For example:

- Health insurance: medical history, lifestyle habits, family health background.

- Motor insurance: driving record, accident rates in your area.

- Life insurance: age, occupation, and overall health.

- The higher the probability of a claim, the higher the premium.

Risk Pooling Concept

- Insurance works on the principle of risk pooling.

- Many people pay premiums into a common pool.

- Only a few will make claims, and the pool covers those claims.

- This spreads risk across a large group, making insurance affordable and sustainable.

Example: If 1,000 people buy health insurance, not all will fall sick at the same time. The premiums collected from everyone help cover the medical costs of those who do.

Low-Risk vs High-Risk Customers

- Low-Risk Customers:

- Young, healthy, safe drivers, non-smokers.

- Pay lower premiums because they are less likely to claim.

- High-Risk Customers:

- Older individuals, people with chronic illnesses, risky occupations, or poor driving records.

- Pay higher premiums because insurers expect more frequent or larger claims.

Illustration: Two people buy the same life insurance policy:

- Person A: 25 years old, non-smoker, office worker → Lower premium.

- Person B: 50 years old, smoker, construction worker → Higher premium.

Underwriting is the backbone of insurance pricing. By assessing claim probability, applying risk pooling, and distinguishing between low-risk and high-risk customers, insurers ensure that premiums are fair and sustainable.

Why Premiums Change Over Time

Premiums aren’t static. They can rise or fall based on:

- Age progression (you get older, risk increases)

- Claim history (filing multiple claims raises costs)

- Market conditions (inflation, healthcare costs, or natural disasters affect pricing)

- Policy adjustments (adding coverage or riders increases premiums)

Unique Angles: The Human Side of Premiums

1. Psychology of Risk

Insurers don’t just look at numbers—they consider human behavior. For example, people who buy comprehensive coverage often take fewer risks, which can lower claims overall.

2. Technology’s Role

Modern insurers use telematics (devices in cars that track driving habits) or fitness apps (tracking health activity) to personalize premiums. Safe driving or healthy living can literally lower your costs.

3. The Fairness Debate

Some argue premiums penalize people for factors beyond their control, like genetics or location. Others see them as fair because they reflect actual risk.

How to Lower Your Insurance Premiums

You can’t control everything, but you can take steps to reduce costs:

- Bundle Policies: Combine home, auto, and life insurance with one company.

- Improve Lifestyle: Quit smoking, exercise regularly, and avoid risky hobbies.

- Maintain a Clean Record: Drive safely and avoid traffic violations.

- Choose Higher Deductibles: Agree to pay more out-of-pocket in exchange for lower premiums.

- Shop Around: Compare insurers—prices vary widely.

Quick Comparison: Risk vs Age vs Coverage

| Factor | Effect on Premium | Example |

|---|---|---|

| Risk | Higher risk = higher premium | Smoker pays more for life insurance |

| Age | Younger = cheaper, older = costlier | 25-year-old driver vs 70-year-old driver |

| Coverage | More coverage = higher premium | Basic health plan vs comprehensive plan |

How to Reduce Your Insurance Premium Legally

Buy early Premiums are lower when you purchase insurance at a younger age since risk is lower.

Choose optimal coverage (not underinsured) Select coverage that matches your needs—too high raises cost, too low leaves you exposed.

Opt for higher deductible (when appropriate) Agreeing to pay more out-of-pocket reduces the insurer’s risk, lowering your premium.

Maintain healthy profile Good health, non-smoking, and safe lifestyle habits keep premiums affordable.

Compare policies Shopping across insurers helps you find competitive rates and better value for similar coverage.

Common Myths About Insurance Premiums

Here’s a quick comparison to clear up common misconceptions about how premiums are set:

| Myth | Reality |

|---|---|

| “All policies cost the same” | Premiums vary widely depending on age, health, coverage amount, and risk profile. |

| “Premium only depends on age” | Age is important, but lifestyle, occupation, medical history, and location also matter. |

| “Medical tests don’t matter” | They do—test results help insurers assess health risks, which directly affect premiums. |

| “Online insurance is always cheaper” | Not always—digital policies may reduce admin costs, but coverage and add-ons can make them equal or even costlier. |

Final Thoughts

Insurance premiums may seem complicated, but they boil down to one idea: risk management. The insurer is betting on how likely you are to need financial protection, and your premium reflects that bet.

By understanding the factors—risk, age, and coverage—you gain control. Instead of feeling powerless when you see your premium bill, you’ll know exactly why it’s priced that way and how to influence it.

Frequently Asked Questions

Why did my premium increase at renewal?

Because your age, claims history, or rising healthcare/repair costs increased the risk.

Can insurers change premium mid-term?

No, unless you modify the policy (like adding coverage or changing details).

Do women pay lower premiums?

In some markets yes, due to lower claim rates, but in regions with gender-neutral laws, no.

Is premium tax-deductible?

Health and life insurance often qualify, but motor/property premiums usually don’t.

Explore MORE ARTICLES