Inflation is one of those economic terms that everyone hears about, but few truly understand. It’s often mentioned in news headlines, political debates, and financial advice, yet the mechanics behind it—and its impact on everyday life—can feel abstract. In reality, inflation is deeply personal. It influences the price of groceries, rent, fuel, and even the value of your savings account.

In this article, we’ll break down inflation in plain language, explore why prices keep rising, and uncover how it quietly erodes savings if left unchecked. By the end, you’ll see inflation not as a distant economic concept, but as a force shaping your financial decisions every single day.

What Is Inflation?

At its core, inflation is the rate at which the general level of prices for goods and services rises over time. When inflation occurs, each unit of currency buys fewer goods and services than before.

Think of it like this:

- Ten years ago, you might have bought a cup of coffee for $2.

- Today, that same cup costs $3.50.

- The coffee didn’t necessarily change—it’s the value of money that shifted.

Inflation is usually measured by government agencies using indexes like the Consumer Price Index (CPI), which tracks the average price changes of everyday items such as food, housing, and transportation.

Why Do Prices Keep Rising?

Inflation doesn’t happen randomly. Several forces push prices upward:

1. Demand-Pull Inflation

- When demand for goods and services outpaces supply, prices rise.

- Example: During holiday seasons, flights and hotels often cost more because everyone wants them at the same time.

2. Cost-Push Inflation

- When production costs increase (like wages or raw materials), businesses pass those costs to consumers.

- Example: If oil prices spike, transportation costs rise, and so do the prices of goods delivered to stores.

3. Built-In Inflation

- Workers expect higher wages to keep up with rising prices.

- Businesses raise prices to cover those wages, creating a cycle.

4. Monetary Factors

- When central banks increase the money supply, more money chases the same amount of goods.

- Example: Printing more currency without increasing production can dilute its value.

Everyday Examples of Inflation

Inflation isn’t just an economic chart—it’s visible in daily life:

- Groceries: A loaf of bread that cost $1.50 a decade ago may now be $3.

- Housing: Rent that was $800 per month in 2000 could easily be $1,600 today.

- Education: College tuition has risen faster than most other categories, making student loans heavier.

- Healthcare: Medical bills and insurance premiums steadily climb, straining household budgets.

How Inflation Affects Savings

Here’s where inflation becomes especially important: it erodes the value of money sitting idle.

1. Purchasing Power Shrinks

If inflation averages 3% per year, $100 today will only buy what $74 buys in 10 years. That means your savings lose value if they don’t grow faster than inflation.

2. Savings Accounts Lag Behind

Most traditional savings accounts offer interest rates lower than inflation. For example:

- Savings account interest: 1%

- Inflation rate: 3%

- Net effect: You’re losing 2% in purchasing power each year.

3. Fixed Income Struggles

Retirees relying on pensions or fixed annuities often feel inflation’s sting the hardest. Their income stays the same while living costs rise.

Inflation’s Double-Edged Sword

Interestingly, inflation isn’t always bad. Economists often argue that moderate inflation is healthy for an economy.

- Pros:

- Encourages spending and investment (people don’t hoard cash).

- Helps borrowers, since debts shrink in real value over time.

- Signals economic growth when demand is strong.

- Cons:

- Hurts savers if returns don’t keep pace.

- Reduces affordability for essentials.

- Creates uncertainty in long-term planning.

Example: Inflation vs Savings Growth

Let’s say you save $10,000 in a bank account earning 2% interest annually. Inflation averages 4% per year.

- After 10 years, your account grows to about $12,190.

- But in terms of purchasing power, that money is worth only about $8,100.

You gained dollars, but lost value.

Inflation Around the World

Inflation isn’t uniform—it varies by country and time period.

- Hyperinflation: In Zimbabwe during the late 2000s, prices doubled almost daily. People carried bags of cash just to buy bread.

- Deflation: Japan experienced periods where prices fell, discouraging spending and slowing growth.

- Moderate Inflation: In the U.S. and Europe, central banks aim for around 2% inflation annually, considered “healthy.”

How to Protect Savings from Inflation

The good news? You don’t have to let inflation eat away at your money. Here are strategies to safeguard your savings:

1. Invest in Assets That Outpace Inflation

- Stocks historically deliver returns higher than inflation.

- Real estate often appreciates faster than general price levels.

2. Consider Inflation-Protected Securities

- U.S. Treasury Inflation-Protected Securities (TIPS) adjust with inflation.

- Similar instruments exist in other countries.

3. Diversify Your Portfolio

- Spread investments across stocks, bonds, real estate, and commodities.

- Diversification reduces risk and increases chances of beating inflation.

4. Avoid Idle Cash

- Keeping large sums in low-interest accounts guarantees loss of value.

- Instead, use high-yield savings accounts or short-term investments.

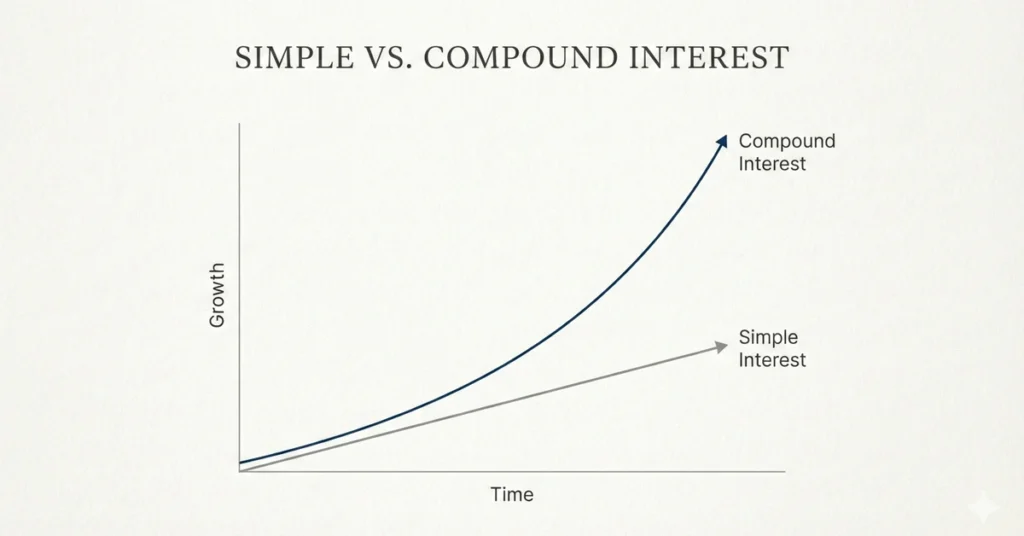

5. Leverage Compound Growth

- Compound interest can offset inflation if returns are strong enough.

- Example: A 7% annual return compounded beats 3% inflation comfortably.

Psychological Angle: Inflation and Behavior

Inflation doesn’t just affect wallets—it influences how people think and act:

- Fear of Rising Prices: People may rush to buy goods before prices climb further.

- Reduced Savings Motivation: If money loses value, some prefer spending now rather than saving.

- Investment Awareness: Inflation pushes individuals to learn about investing, creating more financially literate societies.

The Future of Inflation

With globalization, technology, and shifting monetary policies, inflation’s future is complex. Factors like supply chain disruptions, energy transitions, and government spending will continue to shape price levels.

One unique angle: digital currencies. If widely adopted, they could change how inflation is measured and controlled, since supply can be capped or algorithmically managed.

Key Takeaways

- Inflation means rising prices and shrinking purchasing power.

- It’s driven by demand, costs, wages, and monetary policies.

- Savings accounts rarely keep pace with inflation, eroding value over time.

- Moderate inflation can be healthy, but unchecked inflation damages economies and households.

- Protecting savings requires smart investing, diversification, and awareness of inflation-protected assets.

Final Thoughts

Inflation is like gravity in the financial world—always present, always pulling. You can’t escape it, but you can learn to work with it. By understanding why prices rise and how inflation affects savings, you gain the power to make smarter financial choices.

Explore MORE ARTICLES